Have you ever wondered where all your money goes? One minute you’re cashing your paycheck, and the next, it’s vanished. Imagine if you could save more without feeling like you’re missing out on life’s little luxuries. Sounds like a dream, right? Well, it’s not only possible but simpler than you might think.

Source: Pinterest

Managing money can seem complicated, but these simple strategies will make it easier than ever. So, get ready to learn how to optimize your finances, save money effortlessly, and develop spending habits that align with your goals. By the end of this post, you’ll be equipped to manage your money better and increase your income. Let’s dive right in, shall we?

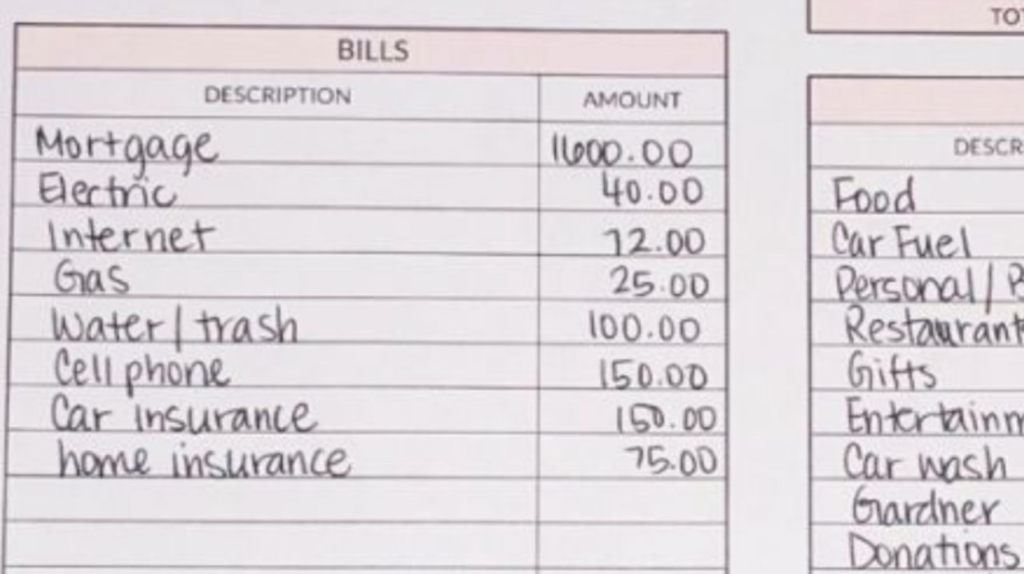

Have a Budget

Managing your money starts with creating a budget. Think of it as a financial plan. It helps you control your spending, pay bills on time, and save money. Without a budget, it’s easy to spend your paycheck quickly and wonder where it all went.

Source: Pinterest

There are various tools to create a budget. You can use an Excel spreadsheet, Google Sheets, or budgeting apps. If you prefer pen and paper, that works too. Choose the method that feels most comfortable for you, making it easier to stick to your plan. A budget gives your money a purpose and direction. You’ll be able to plan for upcoming expenses and ensure you’re not overspending.

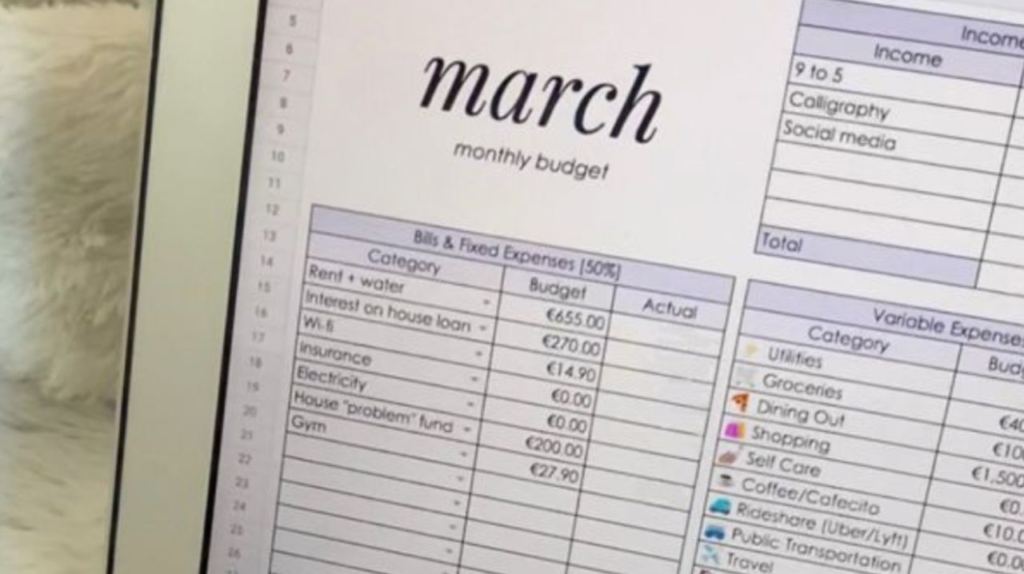

Create a Finance Routine

A finance routine helps you stay on top of your finances. Regularly tracking your spending, reviewing your progress, and updating your budget keeps you aligned with your goals. So, review your finances monthly.

Source: Pinterest

Track where your money goes, adjust your budget, and identify areas to save. For example, if you notice you’re spending too much on takeout, consider cooking at home more often and saving that extra money.

Set Financial Goals

Setting financial goals is essential. You have goals for other aspects of your life, so why not for your money? Think about what you want to achieve in the short and long term. Choose one goal to focus on first to avoid feeling overwhelmed.

Source: Pinterest

Make your goals specific, measurable, and timely. Instead of a vague goal like “build an emergency fund,” aim to “save $5,000 in 8 months.” This clarity helps you track your progress and stay motivated. Break it down into monthly savings targets to make it manageable. Financial goals give you direction and purpose. They keep you motivated and help you prioritize your spending and saving.

Invest

Investing is crucial for growing your wealth. While saving is important, investing allows your money to work for you. Before investing, ensure you have a savings cushion for emergencies. Investing in stocks, for example, can yield significant returns over time.

Source: Pinterest

The S&P 500 index fund has an average annual return of about 9%. This growth, combined with the power of compound interest, can significantly boost your wealth. As a beginner, you can start with simple, diversified investments. Learn about different options and choose what aligns with your goals and risk tolerance.

Put Your Savings in a High-Interest Account

Maximize your savings by using a high-interest savings account. With higher interest rates due to inflation, this is a great time to take advantage. High-interest accounts grow your savings faster by earning interest on your balance.

Source:0o Pinterest

Choose an easy-access account for short-term savings to avoid penalties for early withdrawals. This way, your money is readily available when you need it while still earning interest. Doing this is an effortless way to make your money work harder for you!

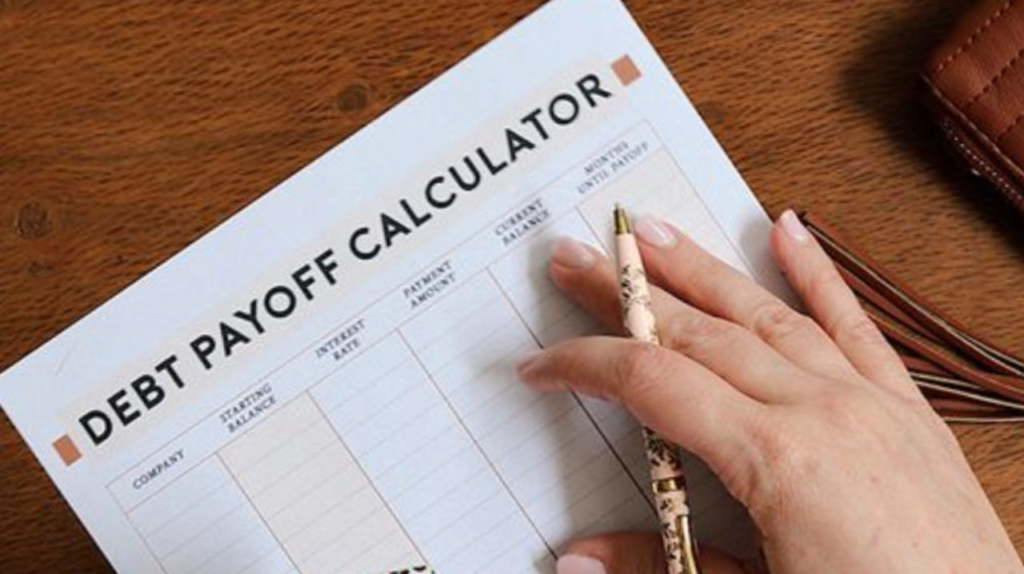

Pay Off What You Owe

Paying off high-interest debt, like credit cards and personal loans, should be a priority. Debt comes with extra costs in the form of interest, which can add up quickly. Focus on paying off your debt to save money on interest payments. Once your debt is paid off, you can redirect those funds toward saving or investing.

Source: Pinterest

You can also make a plan to tackle your debt systematically. Consider the avalanche method, paying off the highest interest debt first, or the snowball method, starting with the smallest balances. Ensure you choose the approach that motivates you the most.

Put Your Savings on Auto-pilot

Automating your savings simplifies the process and ensures you save consistently. Set up automatic transfers from your checking account to your savings account each month. Decide on an amount or percentage of your income to save. It doesn’t have to be a large amount—every little bit counts. By automating, you’re paying yourself first, making savings a priority.

Source: Pinterest

This approach keeps your savings on track without having to remember to transfer money manually. It also prevents the temptation to spend what you intended to save. Over time, you’ll see your savings grow with minimal effort.

Pay Annual Bills Upfront

Paying bills annually can save you money. Many companies offer discounts for upfront payments. For example, you could save on car or home insurance by paying for the entire year instead of monthly.

Source: Pinterest

When it’s time to renew services, compare annual versus monthly costs. The savings might be substantial. Plus, paying upfront can streamline your finances by reducing the number of monthly bills you manage.

Use Money Roundups

Money roundups make saving effortless. Activate this feature on your account, and your spare change from purchases is automatically saved. For example, if you spend $2.50 on a coffee, 50 cents will be rounded up and transferred to your savings. Over time, these small amounts add up without you even noticing.

Source: Pinterest

This is a great way to boost your savings passively. Many banks and apps offer round-up features, making it easy to grow your savings.

Maximize Cashback Websites

Make money while you shop using cashback websites. Sites like TopCashback pay you a percentage back when you make purchases through their links. For instance, if you’re buying from Amazon, go through the cashback site first. You’ll earn cashback on your purchase, effectively reducing the cost.

Source: Pinterest

This hack turns everyday spending into savings. So, sign up for cashback sites and use them whenever you shop online. Over time, these savings can add up significantly.

Use Separate Cards

Using different cards for various expenses helps you stick to your budget. Designate one card for bills, another for groceries and transport, and one for entertainment. This separation makes it easier to track spending and ensure you don’t overspend in any category. You’ll be more mindful of your purchases and better able to stay within budget.

Source: Pinterest

By keeping your spending organized, you can avoid financial surprises and stay on top of your finances. So, try using separate cards and see how it simplifies your budgeting process.