You can call this your personal finance guide already, because that’s exactly what it is. No matter your previous financial knowledge, you can use these tips to manage your finances better.

Source: Pinterest

From setting up automatic savings to investing, these hacks cover various aspects of personal finance. They’re straightforward and practical, so you can start applying them right away.

Automate your savings

You always have saving plans. But, do you see it through? You can remember sometimes and forget the next but don’t worry, I’m here to help.

Source: Pinterest

You should set up your bank account to automatically move some money into a savings account every month. This way, you don’t even have to remember to save or not save. Your bank will do that for you.

Create a Monthly Budget

A budget helps you decide how things should be. Also, it makes you stay in charge of your spending. That’s because you get to determine what you spend on.

Source: Pinterest

You can use a budgeting app to make this easier. But, it helps you manage your finances properly. Having a budget prevents you from spending on impulse, which is one of the things that waste money.

No-Spend Challenge

This is a simple yet effective strategy to improve your financial habits. It involves setting a specific time period where you commit to not spending any money on unimportant things.

Source: Pinterest

It could be a day, a week, or even a month. But the idea is to make you more aware of your spending. You’ll be surprised how much you can actually save and things you can do without.

Unsubscribe From Lists

This hack is all about reducing the temptation to spend. Every day, we receive numerous emails from different stores advertising their latest products and sales.

Source: Pinterest

While they might seem harmless, you might end up buying things you don’t really need just because they’re on sale. So, unsubscribing from these lists would reduce the temptation for you. But you need to be disciplined yourself.

Become Financially Literate

Financial literacy is like learning a new language. Only this time, it’s about money. It’s understanding how money works, how to save, how to invest, just basic financial knowledge.

Source: Pinterest

Knowing these things can make a huge difference in how you use money. You can control your money, instead of letting it control you.

Read Your Card Statements Thoroughly

Every month, make this a must-do. Reading your card statements every month is like doing a monthly health check-up for your money.

Source: Pinterest

These statements tell you where your money is going. So, it’s important to check them carefully. You can avoid mistakes this way. For instance, if a store charged you twice for the same thing, you can report it and get your money back.

Clear Your Browsing History

Would you ever have thought that your browsing history can have an effect on your finances? Well, it does. When you browse, the history is saved and this can show you targeted ads.

Source: Pinterest

You’ll keep seeing things you’ll love to buy. When you clear it, you’ll save yourself from seeing those things everytime and buying on impulse.

Walk, Bike, Carpool

These are different ways to get around that can save you money. If you walk or bike, you don’t have to pay for gas or car repairs.

Source: Pinterest

Carpooling is when you share a ride with others going the same way. So, instead of taking a cab alone, you and others get to share the transportation fare. Obviously, it saves your money a whole lot.

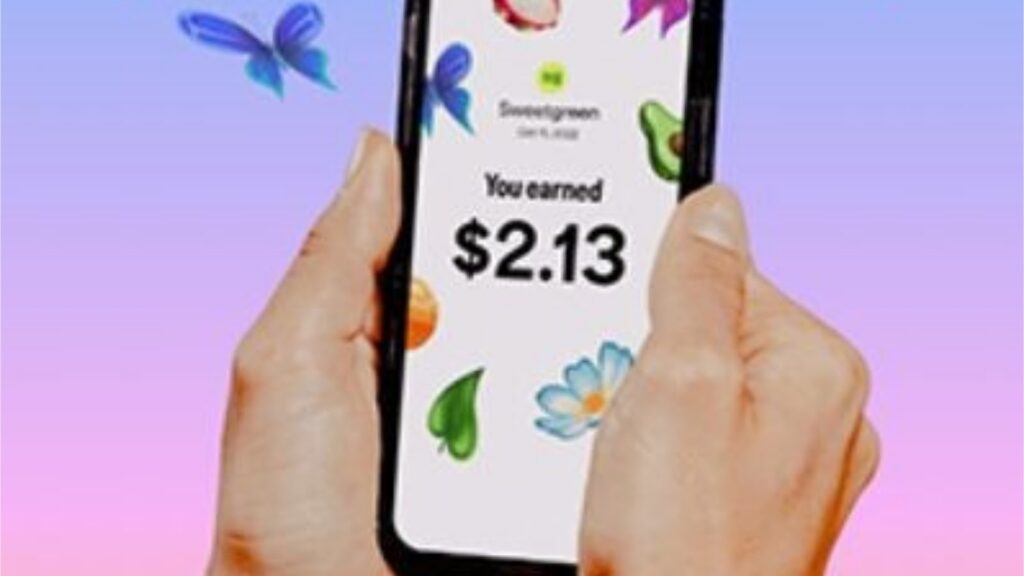

Use Cashback Apps

These are like your secret money-saving pals. When you buy something, these apps will give you a little bit of your money back. It’s like you bought something for $10, and then your friend gave you $1 back.

Source: Pinterest

These apps work with lots of different stores, so you can get money back on all sorts of things you buy. Over time, these small amounts can add up to a big saving.

Invest in Yourself

The greatest investment you can have is in yourself. This means spending time, effort, and sometimes money on improving your own skills and knowledge.

Source: Pinterest

You can apply this to all areas of your life, including your career and hobbies. The more you invest in yourself, the more valuable you become. And this can ultimately lead to better job opportunities, higher income and a more fulfilling life.

Lastly

These are not complicated tips. They’re easy to understand and they can help you make better decisions with your money.

Source: Pinterest

Remember that managing money is not a destination, but a journey. Start from somewhere and progress into others. It may look like you’re boxing yourself but it’s all for your good and your financial development.